In the digital age, financial privacy has become a priority for many. The uncertainty of regulations and taxation when it comes to cryptocurrencies can generate a certain level of anxiety and concern for those who are now in effect users of this parallel, timeless, borderless financial system.

Anonymous prepaid cards that are recyclable with stablecoin or crypto emerge as an intriguing solution for those who wish to maintain anonymity in online transactions. This article explores the concept of prepaid cards without the KYC (Know Your Customer) requirement, explaining how they work, the gift card option, and my personal experience in testing two of these solutions: Laso.finance and Bitstore.com. We will also analyze their compatibility with services such as PayPal and Google Wallet.

What is KYC

KYC, an acronym for Know Your Customer (Know Your Customer), represents a set of procedures adopted by financial institutions to verify the identity of their customers. The KYC process is critical in the fight against money laundering, terrorist financing, and other illegal activities. For customers, this means having to provide documentation to confirm their identity, such as passports, ID cards or driver's licenses, and sometimes even proof of residence such as utility bills or bank statements.

By now with the constant excuse of fighting evasion, the pressure on financial institutions to collect huge amounts of personal data is at an all-time high. Digital payments have further exacerbated this way of doing things, and not everyone is okay with waving their spending habits at lenders.

Despite the importance of KYC for financial security and transparency, many people seek alternatives that allow them to maintain a level of anonymity in their transactions. This desire stems from various reasons, ranging from a simple preference for privacy to the need to protect one's personal data from being compromised or used fraudulently. In this context, anonymous prepaid cards present themselves as an attractive solution, as they allow purchases and financial transactions to be made without leaving a digital trail that can be easily traced back to the user.

How prepaid cards without KYC work

Prepaid cards without KYC work similarly to traditional debit cards, but with one significant difference: they do not require the holder to reveal his or her identity. These cards can be purchased online or in some physical stores, often paying in cash or through other methods that leave no trace, such as cryptocurrencies.

Once purchased, the card can be reloaded with funds of the user's choice, who can then spend them at merchants that accept that type of card. Transactions made with these cards are difficult to trace back to the consumer, thus offering a greater degree of anonymity than traditional bank cards. However, it is important to note that the degree of anonymity may vary depending on the card provider and the specific policies adopted.

In addition to anonymity, these cards offer several advantages, such as ease of use and the ability to control spending since they can be reloaded with a limited amount of funds. This makes them particularly useful for budget management or for those who do not have access to traditional banking services.

A more traditional alternative: anonymous gift cards

Gift cards are an attractive alternative to traditional prepaid cards. Available for a wide range of platforms and stores, gift cards can be purchased without having to provide any personal information, making them an attractive option for those who wish to maintain anonymity in their transactions.

These gift cards can be used for specific purchases at retailers or platforms that issue them, thus offering a degree of flexibility. However, their applicability is, of course, limited to the specific area for which they were issued, which could be a limitation compared to anonymous prepaid cards that, in theory, can be used more freely.

Despite this limitation, gift cards remain a popular choice for those who wish to give gifts or make online purchases without having to disclose their payment information. In addition, purchasing gift cards with cash or cryptocurrency can further increase the level of anonymity of transactions.

The Epipoli Mastercard gift card

This prepaid card, just like more modern alternatives, requires no identification and works just like a real prepaid card. You can use it on any physical store and ecommerce.

You can buy it both online and in a variety of malls or stores with cash. Of course, if it is privacy you are looking for buying it online with a traditional card does not make much sense.

Technically you should find it in an endless array of Supermarkets, appliance stores, and tobacco stores (Conad, Carrefour, Feltrinelli, Trony, Sisal); but in my personal experience, especially in recent times, it is by no means easy to find and I have often found myself forced to use alternative solutions.

The first paper I tested: laso.finance

Laso.finance stands out in the landscape of anonymous prepaid cards for its ease of use and privacy-oriented approach.

The approach is absolutely Web3, all you need to use it is a Metamask wallet and at least 1$ in stablecoin. In addition to Ethereum it supports several L2s including Polygon, Optimism, Arbitrum and Solana.

No emails, registrations or terms of service to agree to. The only drawback is the fees that are not quite at the market minimum. On the recyclable card valid in the US it comes to 6.8% on each reload. While gift cards valid worldwide the situation is much more affordable with fees ranging from 0 to 3.5%. The only problem with the latter is that they are only recyclable once so you are likely to end up with a few cents that you cannot spend.

But let's go into detail.

The fees and limitations of Laso.finance

Beyond the not-so-low fees that we have already discussed and will soon go over in detail I found Laso.finance's approach to be extremely transparent and fair. A single fee applied immediately to the reload and then stop. Other competitors have a different approach and often made of small but constant fees for each transaction, which makes its use tedious since in the end you never know how much you will really spend on a purchase.

There are different types of cards of which one is accessible from the website and another from the extension for Google Chrome and other Chromium browsers (Brave, Edge, Opera, Vivaldi, etc.)

Fees

Paper accessible from the website:

This is the reloadable card valid only in the United States. It has a deposit fee of 6.8%. No transaction fee, no withdrawal fee.

Cards accessible from the Chrome extension:

Extension account balance: No fees of any kind.

USD non-reloadable card: No deposit or transaction fee. 5% withdrawal fee.

CAD non-reloadable card: No deposit or transaction fees. 5% withdrawal fee.

International non-reloadable card: 3.5% deposit fee. No transaction fee. 5% withdrawal fee.

Limits on spending

The only limit set is 1000$ per card per day. Of course, nothing prevents you from using multiple cards with different addresses to increase the spending limit.

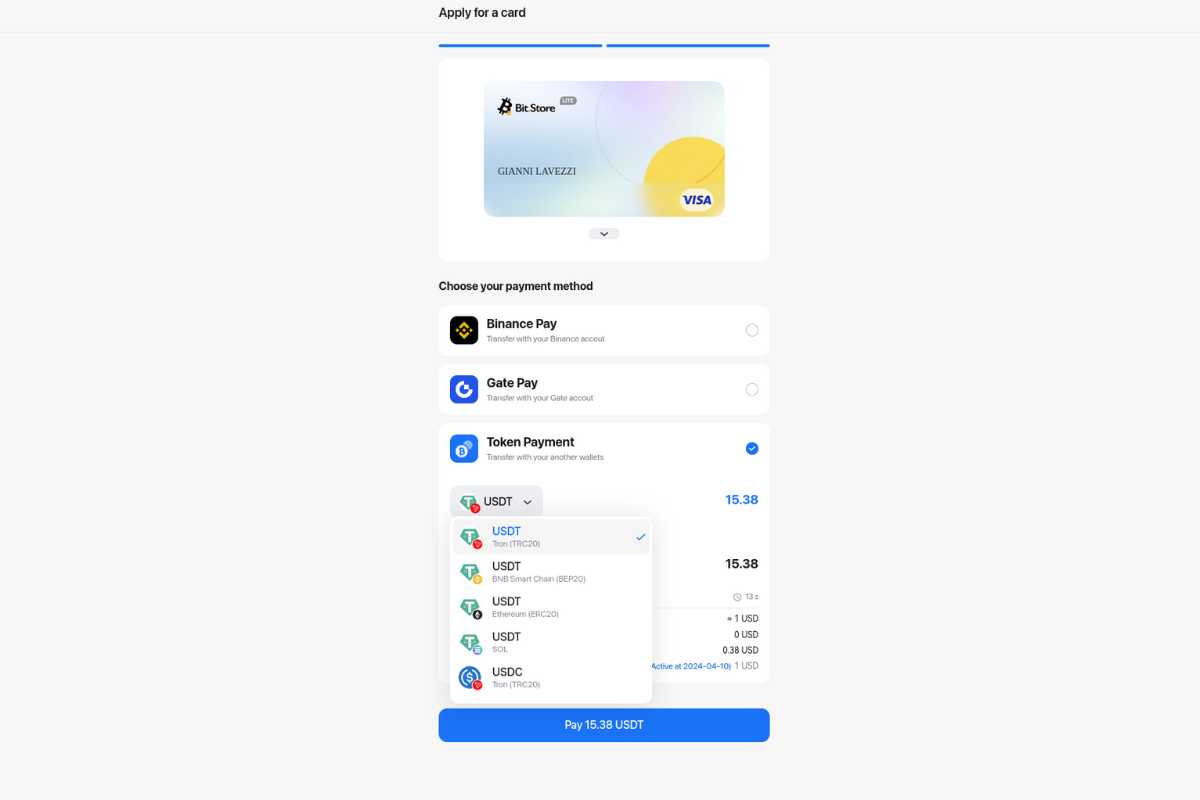

The second paper: Bitstore.com

The Bitstore virtual card is completely anonymous, although there is a need for an email address for registration, it can be reloaded with Bitcon, Ethereum, USDT or USDC. Binance Smart Chain, Solana and Tron are supported as additional networks.

The dashboard asks for a name and phone number before the initial charge but you can safely enter something random.

Fees

La Bitstore card might be a cheaper option for someone since the charging fee is only 2.5%. However, there are a host of other fees to watch out for; there are so many that the only way to summarize them is to draw up a table:

| Item | Limit |

|---|---|

| Maximum balance | $120,000 |

| Minimum recharge amount | $15 |

| Maximum card load limit per month | $10,000 per month |

| Maximum card payment limit per day | $10,000 per day |

| Item | Commission |

|---|---|

| Issuing commission | $0 |

| Monthly commission | $1 |

| Crypto reload commission | 2,5% |

| Consumption commission | Small transactions (Under 10 USD of consumption): 0.15 USD |

| Foreign transaction fee (non-USD purchases) | Below $35: 0.5USD per transaction; Above $35: 1.5% per transaction; Purchases in USD: 0.15 USD per transaction; Purchases not in USD: 0.5 USD per transaction; Purchases not in USD: Additional expenditure of 0.5USD |

| Commission of decline | 0.15 USD |

| Redemption fee | 0 USD |

Mastercard (card bin 553437): Full commission for transactions below $35: 0.5USD per transaction; above $35: 1.5% per transaction. USD purchases: 0.15USD per transaction. Non-USD purchases: 0.5USD per transaction. Additional charge of 0.5USD for non-USD purchases.

Mastercard (card bin 515783, under maintenance): Full commission: 1% per transaction. 0.3USD for non-USD purchases. No redemption fee.

VISA (card bin 441112): Full commission for transactions below $45: 0.5USD + 2% per transaction; above $45: 2% per transaction. USD purchases: 0.15USD per transaction. Non-USD purchases: 0.5USD per transaction. Additional charge of 0.5USD for non-USD purchases.

VISA (card bin 486695): Full commission: 1% per transaction. 0.5USD for non-USD purchases. No redemption fee.

VISA (card bin 476715): Full commission for transactions below $35: 0.5USD per transaction; above $35: 1.5% per transaction. USD purchases: 0.15USD per transaction. Non-USD purchases: 0.5USD per transaction. Additional charge of 0.5USD for non-USD purchases.

I am not a fan of this approach

I mentioned earlier that although maybe in the end the Laso.finance card might cost me more, at least I know exactly how much the final charge is, whereas with the BitStore card I might find myself spending for additional fees on virtually every purchase. There are, however, use-cases where this card definitely costs more.

In general, with a monthly fee of 1$ you can safely try it and compare it with the other card to see concretely which is the best.

Limitations

While for the Laso.finance card there are clear instructions for it to be used with Google Wallet, Apple Pay or Paypal, and virtually be used anywhere; the BitStore card has only an endless sequence of limitations and places where it is not accepted. So much so that on the same site there is practically a list of common places where it can be used.

He who spends more spends better

As you might guess from the general tone of the article, in the end I preferred the Laso.finance card, which has far fewer problems and is more convenient to reload and use in general.

All you have to do is burn a few tens of euros and try both to find out which one is best for you.

Generally speaking, these virtual cards without KYC are a rather easy way to pursue privacy and anonymity, escaping from traditional financial systems; at least until we are able to spend our cryptocurrencies directly in merchant establishments.